The Dance between Centralization and Decentralization in City Governance, Baumol Effect vs. Regulation in Increasing Price Levels and Economic Insights for Entrepreneurs

Podcast Ep.39 with Alex Tabarrok

Key Insights

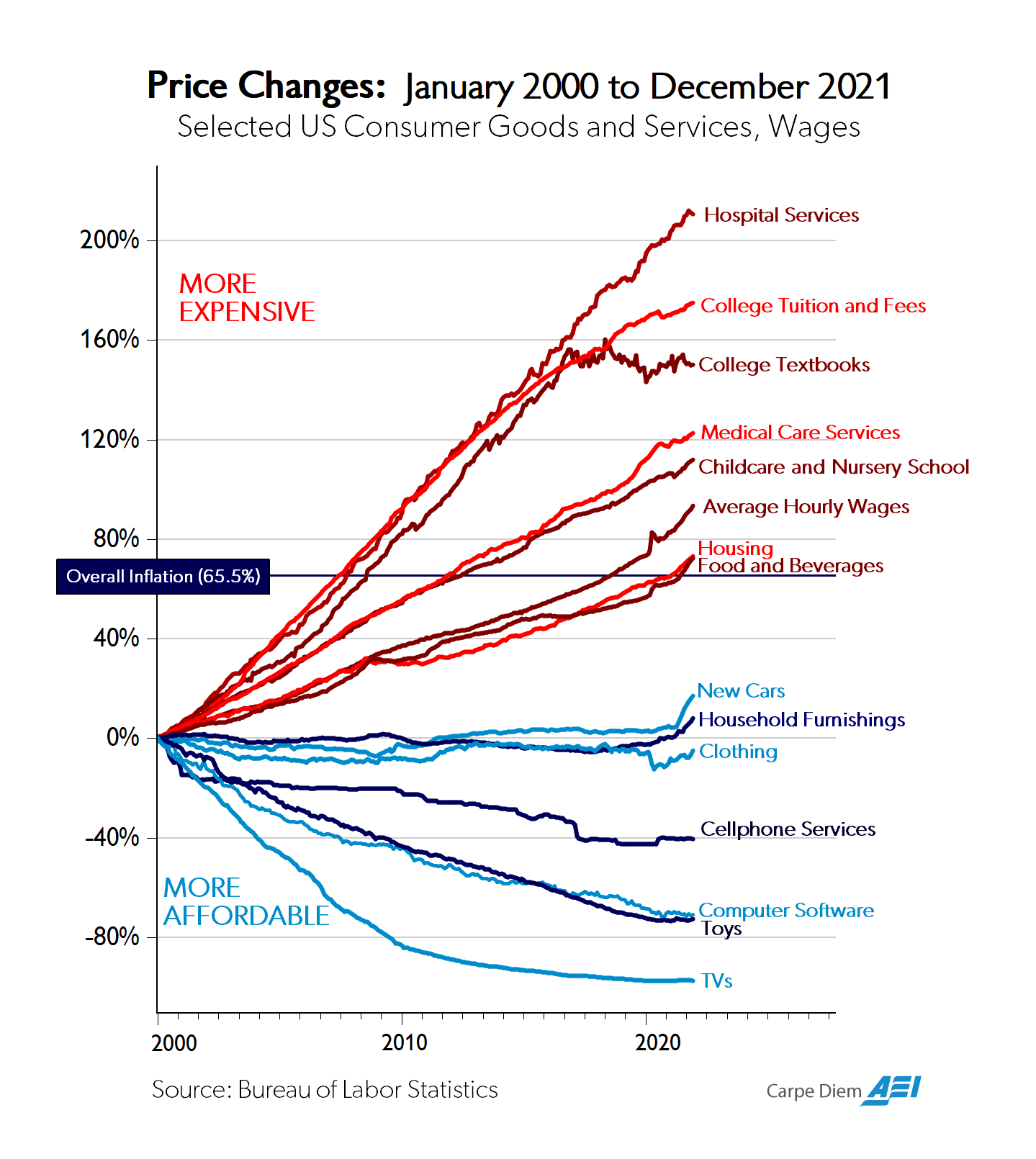

This episode is an intellectual journey that discovers insights that can be used by entrepreneurs and city developers. We talk about the Baumol effect that Alex uses to explain the now infamous price chart.

Alex’s recommendation to new city or governance startups like Prospera, Ciudad Morazan or the Catawba DEZ is to think of city development as a “dance between centralization and decentralization”

Economists have developed concepts that are waiting to be commercialized, e.g. prediction markets. In this episode, we talk about dominant assurance contracts and how they could be used in new city developments and fundraising

Episode Description

Alex Tabarrok is a professor of economics at George Mason University, and a research fellow with the Mercatus Center.

Alex is one of the world’s best teachers of economics and reaching a large, worldwide audience as the cofounder of Marginal Revolution University and the popular Marginal Revolution blog together with Tyler Cowen.

This episode is an intellectual journey that discovers insights that can be used by entrepreneurs and city developers.

Alex has been teaching economics for decades, so we start the episodes with our favorite concepts.

We talk about the Baumol effect that Alex uses to explain the now infamous price chart: why is it that some goods have become much cheaper (e.g. consumer electronics), while housing, education and healthcare have increased?

This informs the thesis of the podcast, which assumes regulatory and political sclerosis are the key obstacles.

The Baumol effect pushes back against this explanation.

The Baumol effect instead offers a more long-run focused macroeconomic explanation: the success of technology adoption in some areas must necessarily correspond to relatively higher costs in other sectors.

The discovery of this effect, however, could be a necessary, not a sufficient explanation. Niklas points at the non-linearity and the many examples of regulation being specific, non-macro factors with a large impact.

Alex and Niklas end up agreeing that overregulation is a large part of the problem.

We further talk about economic insights such as prediction markets or dominant assurance contracts that entrepreneurs can apply in practice.

A problem in the governance of public goods and regulation, however, is that the laws of society are hundreds of years old, and little new innovation is taking place.

However, private cities and special economic zones such as Hong Kong, Shenzhen, and Dubai have shaken up the field in the second half of the 20th century. Alex talks especially about the lessons of Gurgaon, a private city in India.

Gurgaon has been in many ways remarkably successful, but it also had experienced problems funding large public goods such as sewage and electricity.

Alex’s recommendation to new city or governance startups like Prospera, Ciudad Morazan or the Catawba DEZ is to think of city development as a “dance between centralization and decentralization”.

Towards the end, we take a deep dive into dominant assurance contracts as a mechanism for public goods funding - an idea we could use in city development, but also for venture capital and startup funding.

You can help us apply these insights in practice, check out the upcoming builder-focused conferences in Prospera:

Supercharging Health 2023 - A Próspera Builders’ Summit, April 21-23 on Roatan: https://infinitavc.com/healthbio2023

Decentralizing Finance 2023 - A Próspera Builders’ Summit, May 5-7 on Roatan: https://infinitavc.com/defi2023

A free jurisdiction has potential to be a 100x for financial innovation