Overcoming the Regulatory Barriers Set by the Dinosaurs & Creating Ethical VC Funds

Podcast Ep. 30 with Adeo Ressi

Key Insights

Adeo Ressi designed VC Lab to turn venture capital into a force for good in the world.

Starting a VC fund is a black box, and requires a significant amount of upfront capital for legal fees to comply with a set of onerous laws set up as moat by the dinosaurs of the industry through regulation

VC Lab is globalizing access to VC by reducing the barriers to starting a fund for managers, thereby unleashing a new wave of innovation through entrepreneurship.

Episode Description

Adeo Ressi is an iconic entrepreneur, investor, and teacher. He is the CEO of VC Lab, which runs the leading venture capital accelerator. He is also the Executive Chairman of the Founder Institute, the world's largest pre-seed accelerator.

Adeo has launched more than 14 venture capital funds and founded 11 startups, having nearly $2 billion in exits before the age of 30.

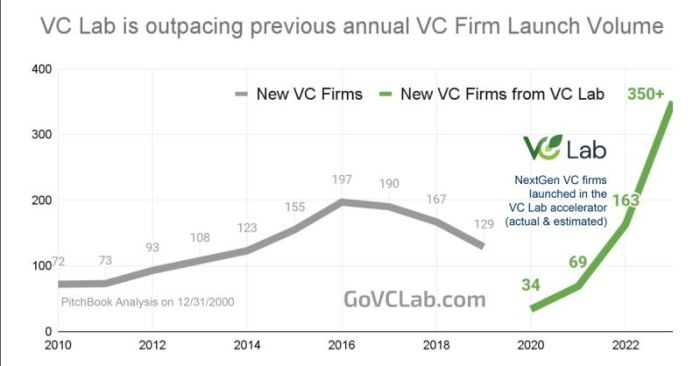

Adeo speaks about his mission with VC Lab. VC Lab has accelerated 236 new VC firms and reduced the time to start a fund from 18-24 months down to 5.8 months.

This episode means a lot to me because I went through VC Lab with Infinita - so I learned from Adeo over a period of almost 6 months.

VC Lab was instrumental for me in starting the fund - it would have otherwise been much harder, if not impossible, to get started.

Back to Adeo’s mission.

VC Lab is designed to turn venture capital into a force for good in the world.

Traditionally, VC is an exclusive club and accessible only in select locations like Silicon Valley, New York, London, Berlin, etc.

Regions like Latam or Africa need entrepreneurship the most to solve local problems, but the locally available capital is predatory.

It is no accident that venture capital has not yet scaled globally: as so often, the barriers are regulatory. The "dinosaurs of the industry" have set up moats.

Starting a VC fund is a black box, and requires a significant amount of upfront capital for legal fees to comply with a set of onerous laws.

VC Lab is solving the problem by creating a full-stack: a free acceleration program, standardized legal advice in three domiciles, and fund management software.

This is an exciting development. It marks the start of a new wave of scaling the Silicon Valley model by exporting it globally.

Y-Combinator is doing that for startups. VC Lab is doing that for VC funds by reducing the barriers to starting a fund for managers.

This mission is close to my heart.

Toward the end of the episode, I share a few thoughts on why I chose VC Lab and a traditional Delaware-3 structure for Infinita.

In upcoming episodes, I will discuss alternative fund models from the crypto and defi world - since I expect a lot of innovation to come from there as well.